Who is DAF Financial Institute?

DAF Financial Institute is an online trading platform, it claims to offer investment opportunities. However, upon closer inspection, several red flags emerge that indicate this may be a potential scam. In this comprehensive review, we will delve into the various scam activities associated with DAF Financial Institute and provide valuable insights to help you protect your investments.

🖥️ : N/A.

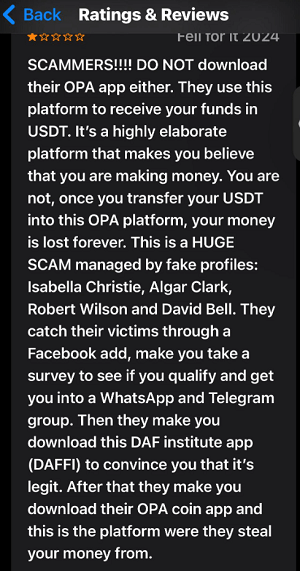

🚩 : Fraudulent Trading Platform / Pig Butchering Scam / Investment Scam.

🚨 : Do not pay any “fee” or “tax” in order to withdraw your funds – it’s a trick to steal more money from you!

📢 : Scam linked to Opacoin.

DAF Financial Institute falls into the category of UNREGULATED platform. When choosing a platform, caution is warranted if the company lacks regulation by any overseeing agency. This should serve as a warning that your funds may not be secure, and there’s no protective regulatory framework. Unregulated entities can potentially abscond with your money without being held accountable.

How does the scam unfold?

Scammers employ persuasive tactics to convince you to make an initial minimum deposit. They entice with promises of doubling the deposit within 24 hours and similar claims. After obtaining the initial deposit, more experienced scammers may be brought in to extract additional funds. The cycle persists, but it is possible to put an end to it, even if you’ve fallen victim to their deceitful promises.

Is It Safe To Invest With DAF Financial Institute?

Dealing with an unregulated company like DAF Financial Institute increases the risk factor of your money. Once the money is deposited with it, it stops responding to the queries.. Therefore, we do not recommend you to invest money with DAF Financial Institute.

Red Flags and Scam Warning Signs

To help you identify potential scams, we have compiled a list of red flags and scam warning signs associated with DAF Financial Institute:

- False claims and unrealistic promises of high returns.

- Lack of transparency regarding risk warnings and hidden information.

- Utilization of stock images and paid actors to portray fake staff members.

- Illegitimate rules and policies for withdrawals.

- Sudden unavailability of the broker or website downtime.

- Changing identities and website URLs without notice.

Did that happen to you too?

🆘 Are you victim of scam? Fill the form below or Use our Chatbot and get a Free Consultation from CNC Intelligence Experts, they can assist you by investigating your case and tracing your funds. You should also contact your bank as soon as possible and let them know about your issue.

Rosy Klein

Faye

Roger Pihl

Good citizen

Roger Pihl

Jay

Paul myerd

BFO

Krishna

Robert Stone

Krishna

Srinath

K

BFO

Faye

Fay

DAF Scam

Philip Banz

Jay

Paul

Krishna

Srinath

Krishna

Kris

Tim state

Patty

Jay

bFO

CHI

Patty

Lisa

Jay

Tim state

Jay

Jay

Melissa

Jason

Jay

Patty

Roger Pihl

Peter

Jay

Sager hattar

Roger Pihl

Dave

Ts

Jay

Patty

Jay

SS

patty

Tracey cratsley

Jonathan

Noleque

Jay

Jeremy

Ts

Roger Pihl

SS

d

Ts

EE

NK

Patty

Ts

RS

Roger Pihl

Connie Wheeler

Jay

KKeoka

Roger Pihl

Jay

Dutchess

Paul

SA

Paul

A

BFO

BFO

Roger Pihl

Cristina

Jay

Jay

TS

BFO

DJG

Jay

Roger

Donna

Chai

Jay

Paul Myers

Jay

Jay

SA

Chai

Chai

Roger

SA

TS

Jenny

Jay

Chai

Jay

Roger

Eunice

Roger

Jay

Ee

Jay

Jay

RS

Jay

Chai

Jay

RS

NK

RS

Raymond Rodgers

RS

SA

Bestman Osagie

sa

Amged Rafla